Complex electronics and longer lifetimes will require much tighter supply chain management.

Keeping automobiles updated enough to avoid problems is becoming increasingly difficult as more complex electronics are added into vehicles, and as the lifetimes of those devices are extended to a decade or more.

Modern vehicles are full of electronics. In fact, the value of electronic devices used in modern vehicles is expected to double in the next 10 years, growing to $469 billion by 2030 from the current $238 billion, according to McKinsey & Co.

These parts, which have semiconductors at their core, flow through a complex and ever-changing supply chain.

“The automotive OEM supply chains are becoming more complex,” said Willard Tu, senior director for automotive at Xilinx. “What used to be a linear relationship now has evolved to be a matrix system. For example, some automotive OEMs are now developing their own ASIC, bypassing the Tier 1 suppliers. Additionally, to support a long product lifecycle in general, the hardware needs to be capable of upgrading using over-the-air (OTA) communication, as well as being field programmable.”

Fig. 1: The modern automotive supply chain is complex and is changing constantly. Source: Assent Compliance

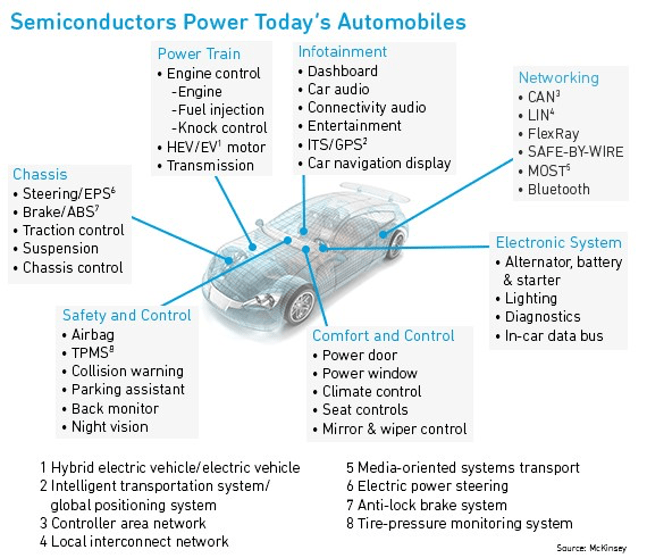

Electronics are a major selling point for new cars and trucks, and it’s evident in the bills of materials. What’s less obvious is these devices have been steadily taking over operations that involve vehicle safety. Whenever you use the cruise control on the freeway, back up while checking the dashboard camera, or are warned that somebody is approaching you from a blind spot, electronics are in action. Semiconductors sense, monitor, manage, and control almost every operation within the vehicle.

The semiconductor parts are built by many different suppliers throughout the world. But when a design change occurs, such as replacing a processor to improve performance, who is responsible for making sure the change will not impact reliability of a system or even the entire vehicle? The answer isn’t always obvious.

Fig. 2: A simplified supply chain block diagram. Source: Tech Idea Research

Applications of electronics in modern vehicles

Modern vehicles are equipped with embedded processors, components, and modules aimed at improving performance, fuel efficiency, comfort, and overall safety.

New components can add new features, or improve on existing features. For example, traditional cruise control, before the introduction of the advanced driving assistance system (ADAS), required the driver to reactivate this system once the brakes were applied. Today, most luxury cars are equipped with adaptive cruise control feature, which uses radar to detect a car’s distance from the vehicle in front, automatically slowing the car if necessary. This feature also enables the vehicle to accelerate to the preset speed limit without driver interference.

In the not-so-distant future, fully autonomous driving may be available to consumers, at least in some geo-fenced areas such as on highways. All of these functions will be performed by the embedded electronic controllers (EEC). It is not uncommon for a modern vehicle to have more than 100 such controllers propelled by automotive-grade semiconductors. Today, chips used in vehicles range from 4-bit to 64-bit, depending on the complexity of the operations. Autonomous vehicles will use 128- to 256-bit GPUs to perform machine learning.

EECs manage the following devices and functions:

Fig. 3: Embedded electronics, especially semiconductors, are used in modern vehicles to control almost every operation. Source: McKinsey & Co.

Additionally, according to McKinsey, the complexity of automotive software has grown fourfold over the past 10 years. But software development productivity has increased by only about 1X to 1.5X. Compared with traditional industrial and embedded software, the auto industry is behind by about 25% to 35%. The implication is that the auto industry’s software capability lags other embedded industries.

Fig. 4. The complexity of automotive software has grown fourfold over the past 10 years. Source: McKinsey & Co.

How automotive OEMs manage updates

Advanced semiconductor processors consist of billions of transistors, and automotive software has millions of lines of code. It’s almost impossible for such complex designs work flawlessly. From time to time, updates will be needed for software and semiconductor firmware and programmable logic.

Some updates are done routinely, such as when the ADAS system downloads new maps. Other updates are necessary to address safety issues, as required by the National Highway Traffic Safety Administration (NHTSA). Still other updates are necessary to improve performance, as in the case of autonomous driving. For example, a GPU-based machine learning system may need to connect to a knowledge database to improve inferencing, or decision-making, capabilities.

In general, semiconductor updates are done for one of two reasons. The first is bug fixing or security software patching. The other is for performance enhancement, such as increasing downloading speed for an infotainment system migrating to an LTE Category 9 connection. These updates can be done as firmware or software via over-the-air (OTA) technology, or physically through processor, hardware module, or system replacement.

“Semiconductors go through updates from time to time. Some are for bug fixing,” said Kurt Shuler, vice president of marketing at Arteris IP. “Other updates will add new features to, say, the ADAS systems. Those can completely change the personality of the vehicles.”

The basic considerations for making updates include benefits, cost, time, and effort. The auto industry, until recently, has been cautious about making any changes. Products historically were designed on a 4- to 7-year cycle, and expected to last for 10 to 20 years. Change was considered costly and potentially risky. But with the introduction of advanced vehicle electronics, OEMs see increased functionality as a way to gain marketplace leadership, and to stave off incursions by Tesla and a growing number of electric vehicle startups, including Rivian, Lucid, Polestar, Nio, and Nikola. There are literally dozens of these new companies, and they are forcing the incumbent automakers to think very differently about making changes.

Economics of recalls

There is still an element of caution for all of these companies. Automakers need to determine whether an update is absolutely necessary, and what is the most economical way to accomplish that. But electronic architectures may provide a much faster and less expensive route, particularly if changes simply can be downloaded into a vehicle.

This was the case earlier this year when Mercedes-Benz USA announced the recall of 1.29 million vehicles sold since 2016. Certain models equipped with the automatic eCall system may report an inaccurate vehicle location when a crash occurs. The company intends to provide a software update over the air (OTA) or through its dealer network.

In contrast, Tesla recalled 135,000 vehicles earlier this year, as requested by the National Highway Traffic Safety Administration (NHTSA). A media control unit failure in the recalled Tesla cars caused nonfunctioning of the defrost, climate control settings, and the exterior turn signals. Because multiple systems were connected, the malfunction meant drivers backing up their vehicles had no rearview camera display. The corrective action required the replacement of the entire media control unit.

Recalls can be expensive. Besides their impact on profit, they can damage a brand. But they’re far less intrusive, and less memorable, when they require no action on the part of the vehicle owner.

Recalls generally fall into the category of unplanned updates. When a problem is discovered that results in an emergency vehicle recall, OEMs are required to fix the problem. If an OEM is responsible for the defective devices, then the OEM will bear the cost. If the defective devices come from a Tier 1 supplier, then the supplier will bear the cost of the updates. Usually, an OEM or a supplier is covered by business insurance, which ultimately pays the costs.

For planned updates, a Tier 1 supplier agrees in advance to provide, say, four new features of an in-cabin system to an OEM throughout the year. The suppliers usually enter into a contractual agreement in advance, defining the fees involved. In this case, an OEM can plan ahead and schedule software / firmware updates via OTA or other means.

Total quality management

The ultimate goal is to produce safe and reliable products with zero defects, which maximizes profits and minimizes liabilities. To achieve those goals, OEMs must ensure their products are in compliance with the safety standards. Additionally, cybersecurity standards must be followed. Without security, vehicles will never be safe, and security updates are a constant for any connected electronic device.

For automotive, a number of standards are in place. Among them:

“A big part of the challenge for OEMs is managing software updates,” said Chris Clark, senior manager for automotive safety and security in Synopsys’ Automotive Group. “The OEM must validate and test the software update to ensure it will work in the vehicle, and that there are no secondary side effects before they deploy the vehicles on the road safely. The International Organization for Standardization (ISO) is currently developing a new standard (ISO 24089) to guide over-the-air software updates by auto manufacturers. It is vital that there is good communication throughout the supply chain (from OEMs to tier 1 suppliers, to companies that provide chip design tools) to ensure that cybersecurity best practices are being followed.”

The monitoring processes

All OEMs have some kind of enterprise resource planning (ERP) systems in place. It allows the OEMs to track all the records and activities of the entire supply chain. The materials used to build the vehicles are clearly listed in the BOM, which includes detailed information on each semiconductor, electronic component, and licensed software along with release level, release date, supplier information, and specifications. Any changes made, no matter who does the initiation, must be accompanied with an engineering change request (ECR) or product change request (PCR) form. When the changes are carried out, they require clearly written engineering change order (ECO) or product change order (PCO) forms. All this information must be stored in the ERP system.

These days, the global supply chain covers sources from all over the world. Tier 1 and Tier 2 suppliers often employ subcontractors to build part of their products. OEMs will need to make sure contractual agreements are in place to ensure both the Tier 1 and Tier 2 suppliers will deliver the quality they have promised by meeting the predefined specifications. Finally, OEMs need to conduct regular supplier audits to ensure each supplier is active. Sometimes the discontinuation of software being used by an OEM is discovered after the fact. With a good monitoring process, such surprise discoveries won’t happen.

“One way to track critical ICs or processor ICs in the automotive design is to have a unique identity for each silicon die,” said Lee Harrison, automotive test solutions manager at Siemens EDA. “A hardware root of trust (RoT) ID can be generated as part of the manufacturing process. Once a device is fully tested, the ID will be provisioned. It is a unique identity for the in-life data associated with the device used with that one specific vehicle. Not only can the OEM track that critical processor, but if the device is replaced by a stolen or black market device, this can be easily detected and the appropriate action taken — either features/functions are disabled or the whole device/ECU could be rejected by the vehicle. This ensures the safety and integrity of the vehicle, especially when the IC is used in a safety-critical system.”

However, this can get very complicated very quickly. Understanding the performance and integrity of complex electronics is a lot different than for a mechanical part, or even a simpler semiconductor. Sometimes the only way to track a problem is to analyze the data being generated by a sensor how that data is interpreted by a machine learning system.

“A lot of designs in automotive are highly configurable, and they’re configurable even on the fly based on the data they’re getting from sensors,” said Simon Rance, head of marketing at ClioSoft. “The data is going from those sensors back to processors. The sheer amount of data that’s running from the vehicle to the data center and back to the vehicle, all of that has to be traced. If something goes wrong, they’ve got to trace it and figure out what the root cause is. That’s where there’s a need to be filled.”

Quality control

Total quality management covers design, manufacturing, and the entire supply chain. The final quality is only as good as its weakest link. In addition to supply chain management, components and modules coming into the warehouse as well as going out from the warehouse need to be monitored at all times. Supplier specifications should clearly spell out that any component form, fit, or function change must be reported by the supply chain (Tier 1, Tier 2, subcontractors, component, and semiconductor suppliers) to the OEMs.

Two major emerging trends will impact the auto industry greatly. First, the automotive platform will use a more powerful processor to consolidate some of the embedded computer controllers. For example, instead of using one platform for in-cabin operation and one for infotainment, one combined platform will perform both functions.

An in-cabin system has a smart camera and AI software for monitoring passengers in order to increase safety. When the driver has his eyes off the road or distracted driving is detected, the in-cabin system, in conjunction with the OEM human-machine interface, will alert the driver. Another added benefit of a larger platform with a powerful processor is that it shifts some of the processing burden from software to hardware, decreasing component use.

“In future automotive computing architecture design, faster FPGA and graphic processor units (GPU) will be used to provide faster computing functions for machine learning. As processors become faster and more powerful, more embedded electronics will be consolidated. OTA will provide a better route for future semiconductor updates,” according to Tom Herbert, product director at Veoneer, which makes in-cabin systems for occupant protection.

The second trend is the convergence of automotive and mobility technology. “With the advance of wireless technology including Wi-Fi, 5G, RF, satellite, and V2X, vehicles will become more connected. However, mobility technology, coming from the consumer side, is evolving much faster than its automotive counterpart,” according to Gorden Cook, general manager of the Transport Business Unit at Qorvo.

Potentially, vehicles will lag behind what consumers want unless the auto industry adjusts quickly. For example, the automotive telematics control unit (TCU) which manages the infotainment system evolves slower than consumer mobile products. Typical new automotive platform developments, whether they are for in-cabin or infotainment will take about 4 to 7 years, while their consumer counterpart may take 2 to 3 years. Additionally, smartphone suppliers frequently send users operating system updates over the air (OTA). Any smartphone user knows how to do the update. But it is a different story for automotive. Today, the automotive OTA update is still in its infancy. Over time, it is expected that the auto industry will learn from the consumer side.

Conclusion

Updates come in multiple forms, and the happen for different reasons. But as more complex electronics are used in vehicles, and as automobiles increasingly are connected to infrastructure and to each other, those updates will become more regular and affect more systems within vehicles.

There are economic, security, and brand perception implications for fixes and updates, and they extend across a global supply chain that includes startups that may be acquired or go out of business sometime within the anticipated lifetime of a particular part. This makes managing of the supply chain all the more challenging, and ultimately it may force automakers to tear down some of the silos that have existed for years between design, production, and repairs. In this increasingly electronic automotive world, the lines are lot less distinct and changes will be required on a much more frequent basis.

Leave a Reply