Top House Tax-Writer Backs Adding Credit for Chips to China Bill

- Senate bill offers 25% tax credit for chip manufacturing

- Formal negotiations on competition deal begin Thursday

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

More lawmakers say they’re looking to add tax breaks for semiconductors to a sweeping package aimed at bolstering US competition against China.

Negotiations on the compromise bill are set to formally begin Thursday, with a goal of wrapping up by the end of the summer. The House- and Senate-passed bills (H.R. 4521 and S. 1260) include more than $50 billion for chip grants, but lawmakers say there’s a need for tax credits as well.

House Ways and Means Chair Richard Neal (D-Mass.) on Wednesday threw his support behind an effort to add a chip tax incentive based on the Facilitating American-Built Semiconductors Act.

Senate Finance Committee leaders Ron Wyden (D-Ore.) and Mike Crapo (R-Idaho) are also pushing for the credit’s inclusion. The Senate version of the bill (S. 2107) would provide a 25% tax credit for investments in chip manufacturing facilities or related equipment.

Semiconductor Tax Break Sought by Senators in Competition Bill

Neal said he supports extending the credit to cover chip research and development, as reflected in the House version of the bill (H.R. 7104).

“Research and development is a priority for me,” Neal said in an interview. “There’s grand opportunity here.”

Rep. Michael McCaul (R-Texas), sponsor of the FABS Act, will push for research and development to be included in the negotiations, his staff said in an email.

Industry has welcomed the one-time grants already in the China bills, but companies also hope to win recurring tax incentives that won’t be subject to repeated congressional approval. A semiconductor industry executive said the House version of the FABS Act is ideal because it applies to the broader supply chain, not just manufacturers.

Separately, Rep. Anna Eshoo (D-Calif.) said she will advocate to include her printed circuit board tax incentive bill in the conference.

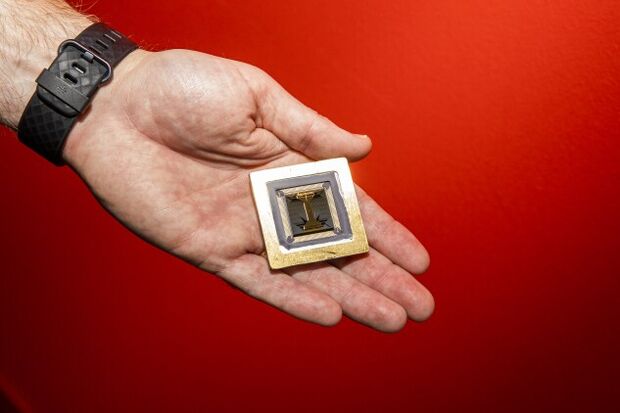

The Supporting American Printed Circuit Boards Act (H.R. 7677), cosponsored by Rep. Blake Moore (R-Utah), would provide tax incentives to manufacturers, researchers, and buyers of PCBs, which provide the foundation tiny semiconductors rest on.

“If we can get it in it would be wonderful,” Eshoo said in an interview. “It’s got good bipartisan support and we need help with circuit boards.”

To contact the reporter on this story: Maria Curi in Washington at mcuri@bloombergindustry.com

To contact the editors responsible for this story: Sarah Babbage at sbabbage@bgov.com; Anna Yukhananov at ayukhananov@bloombergindustry.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.