China’s trade disputes with Australia, US and Japan push Beijing to alter course and plan accordingly

- Experts say geopolitical and trade rifts could persist, but China is also looking to join larger multi-country pacts

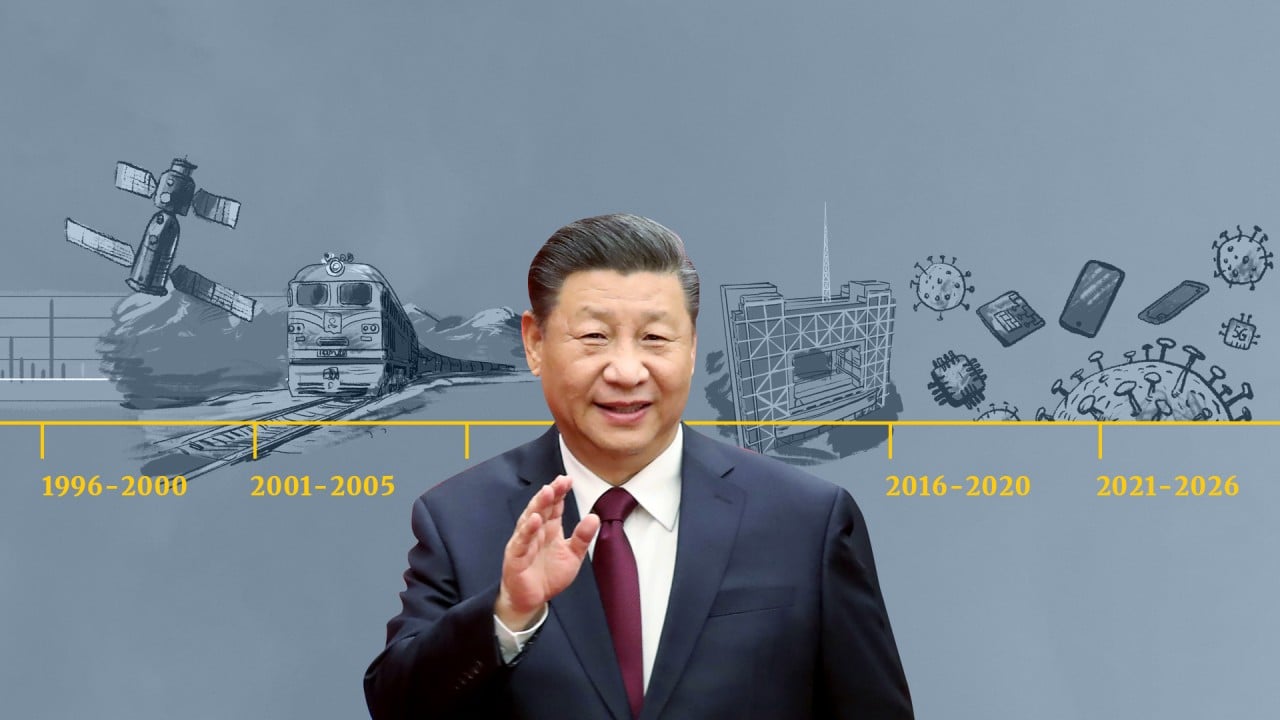

- Tech-related targets make up a big part of China’s five-year plan through 2025, but it could take years for innovation goals to be realised

Snagged on trade disputes with key partners, China is expected to focus this year largely on multilateral agreements and its own hi-tech development for sustained economic growth.

The World Bank in December forecast 5.1 per cent gross domestic product growth for China in 2022 – one of the slowest rates of the past half-century for a country long dependent on exports from its massive factory complexes.

“China’s trade policy with respect to the United States has been more reactionary than anything else – responding to, rather than initiating, changes on a tit-for-tat basis,” he said.

China’s trade with Australia, Japan and the United States totalled US$648.7 billion in 2020.

World Bank sees sharp slowdown for global economy, cuts US, China forecasts

Multi-country trade pacts

China’s official Xinhua News Agency indicated that the RCEP had healing power. “The RCEP will strongly offset the impact of raging protectionism and unilateralism, bringing free trade and multilateral cooperation back to the fore,” Xinhua said in a commentary last month.

Accession to the Pacific Rim deal would “increase Beijing’s relative regional influence and prompt more calls for the Biden Administration to also join the pact”, according to the United States Institute of Peace research institution’s China expert, Carla Freeman.

Membership in RCEP will expose China more to South and Southeast Asia, where countries already depend on Chinese raw materials, clothing and consumer electronics such as mobile phones. China entered a separate free-trade agreement with the 10-country Association of Southeast Asian Nations bloc in 2010.

What are China’s industrial subsidies and why are they so controversial?

China is now negotiating a pact with the five-country Gulf Cooperation Council and another with Japan and South Korea – one that stands to ease stop-and-go friction with both.

Domestic hi-tech development

Hi-tech, a field especially cramped by Sino-US tensions since 2018, shows signs of relying more on domestic sources.

Beijing is investing US$1.4 trillion in tech through 2025 for boosts in artificial intelligence and wireless infrastructure. Much of that money will be spent in Shenzhen, the southern tech hub that has already been dubbed a Chinese Silicon Valley, as it is the home base for networking hardware giant Huawei and internet powerhouse Tencent.

China was more known for copying tech products and services … This is changing rapidly

The plan includes a focus on making technology self-reliant while still encouraging foreign direct investment, S&P Global Market Intelligence said in a March 2021 research note.

“In both software and hardware, we’ve seen China’s tech industry become much more sophisticated. And with tech self-reliance as part of the country’s five-year plan, we should see an entirely different tech landscape in China by 2030,” said Zennon Kapron, founder and director of the Shanghai-based financial industry research firm Kapronasia.

“Initially, China was more known for copying tech products and services from other markets, than it was known for developing its own home-grown technology,” he said. “This is changing rapidly.”

No all-out withdrawal

Trade could be discussed at the National People’s Congress in Beijing next month, revealing any new policy directions.

The Ministry of Commerce’s foreign trade director-general, Li Xingqian, said at a January 25 news conference that 2022 was a year to “consolidate and advance”.

To do that, Li said, China will manage the credit supply in foreign trade, help companies overcome difficulties and “make better use of the negotiated or signed free-trade agreements”. He also noted that more focus would be placed on industrial parks and special trade zones plus the promotion of a “streamlined” flow of goods and materials.

“The foreign trade situation is grim this year, with unprecedented difficulties and pressure in maintaining steady growth,” Li said.

China must keep up one-on-one relations with its major trade partners, even while reducing dependence, experts believe.

‘More pro-growth policies’ expected to help boost China’s economy

The Pacific Rim trade pact that counts Japan and Australia as key members has not accepted China’s membership.

Chinese consumers, meanwhile, will continue to demand farm products from the United States while companies may still need “intermediate goods” for production, said Song Seng Wun, a Singapore-based economist in the private banking unit of Malaysian bank CIMB.

China will continue to tap the United States for technology because most of its IT today is about production rather than invention, said Alan Chong, an associate professor at the Singapore-based S. Rajaratnam School of International Studies.

“When it comes to innovation, they still have to look up to the United States,” he said. “The Chinese can be cleverer in producing things at breakneck speed, but it doesn’t mean they’re going to be true innovators over the long term.”