Why Chinese AI and semiconductors could fall decades behind under US chip ban ‘blitz’

- Washington’s latest move to restrict access to chip-making equipment dims Beijing’s hopes of buying from non-US suppliers such as the Netherlands

- Without foreign technology, it could take at least 20 years for China to regain lost ground, according to industry consultant

As the US pushes to keep China from getting the latest chip-making technology, tightened sanctions could cause Chinese semiconductor and AI development to fall decades behind, according to industry insiders.

China asks Netherlands to safeguard supply chain as US curbs chip tech

“With the agreement between the US, the Netherlands and Japan, the door to non-US equipment, which the entire Chinese chip industry has relied on for survival for the past two years, has been officially shut,” said Leslie Wu, a Taiwanese semiconductor industry consultant and the environmental, social and governance (ESG) VP of Jinhong Gas.

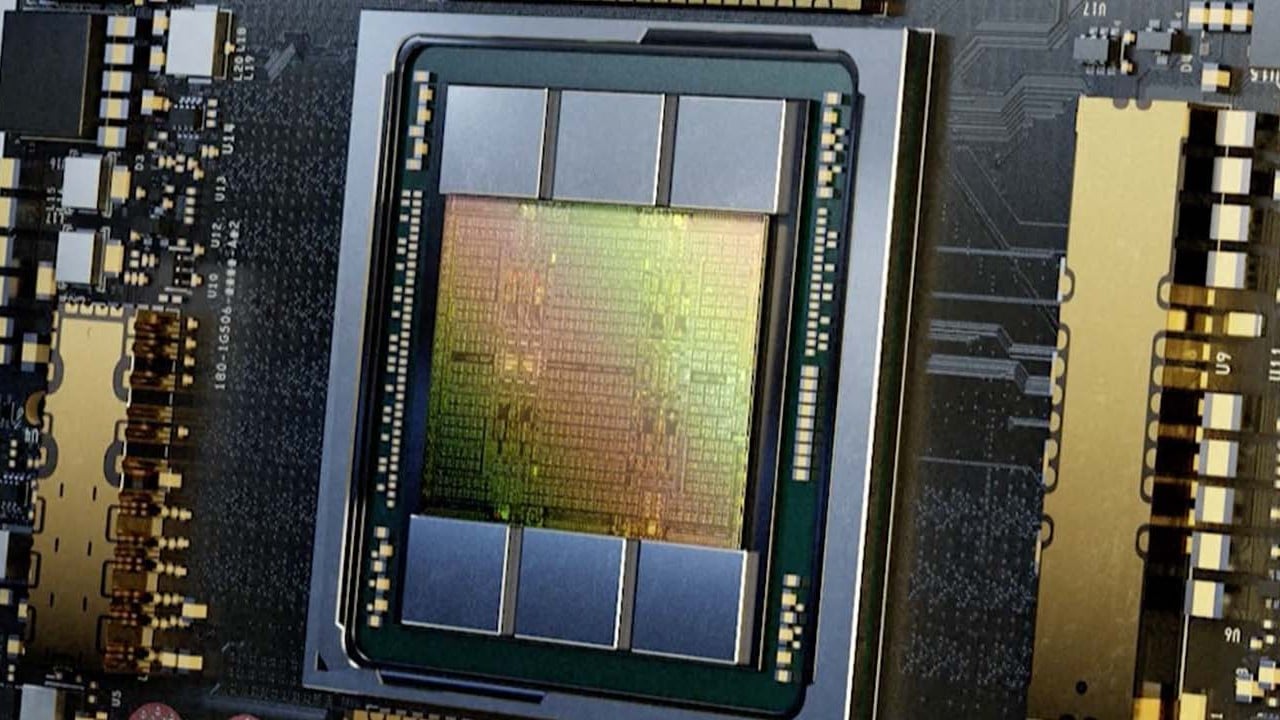

For instance, Nvidia A100 and H100 chips, with built-in infrastructure for training artificial intelligence models and algorithms, including computer vision, natural language processing and conversational AI, have been banned from export to the Chinese market since last August.

Would a Cold War-style agreement help prevent China-US tensions from escalating?

The sanctions have led to an imminent shortage of high-performance chips, pushing up the price of those still available, draining profit margins and dissuading potential clients, according to the founder of an AI software start-up in China who did not want to be named because of the sensitivity of the issue.

“Our cost to buy chips has gone up five to six times,” he said.

He said in the long run, fears of violating sanctions could force large companies to redesign their products or even withdraw, and small and medium-sized companies could face severe difficulties, with many going bankrupt.

Even those that survived would see their R&D funds cut and innovation capacity weakened, and the whole sector would shrink, he added.

“In my opinion, it was a ‘blitz strike’ for the Americans to effectively exploit the Chinese AI sector’s dependence on US-controlled global design and manufacturing systems,” the AI start-up founder said.

He added that while the sanctions hurt market players badly, they posed much less of a problem to non-market players such as military AI researchers. Military users generally have fewer constraints when it comes to size, weight and power consumption, allowing multiple older chips to take the place of one advanced chip.

“The impact of the sanctions on the military would be in the long term,” he said, while noting that an environment that allows civilian technologies to flourish would provide a better foundation for the development of military applications.

Will US Chips Act force academics, tech companies to ‘pick sides’?

US export authorities cited the chip technology’s military potential as the reason for sanctions, saying it could be used to produce weapons of mass destruction and advanced military systems, improve military decision making, planning, and logistics and “commit human rights abuses”.

The PLA could also use AI for “cognitive domain operations” to create deep fakes, disseminate propaganda, analyse public sentiment online and run bot networks on social media, the report said.

In 2021 alone, Chinese buyers bought US$2.17 billion worth of chip-making equipment from Netherlands-based ASML Holding, the world’s leading manufacturer of photolithography systems. That was despite an existing Dutch government ban blocking the company from selling its most advanced machinery to China.

The tightened sanctions leave China no option but to build a self-sufficient semiconductor industry.

Alan Estevez, the US Commerce Department’s undersecretary for industry and security, said in December that the export controls would “slow” China but just “for a period of time”.

“They will figure this out,” he said. “But what we’ve done is pretty comprehensive.”

From chips to visas, US lawmakers stay focused on curbing China

According to analysts, China’s independent semiconductor industry will start at a disadvantage compared to global leaders, and the sanctions will cause it to fall further behind.

Wu said that without foreign technology, it would take at least 20 years for China’s semiconductor industry to regain lost ground and narrow the technological gap to what it is now, with China lagging by about three generations.

There are physical limits to silicon chip density, or the number of components that can fit on an integrated circuit. As industry leaders approach the limit, improvement becomes exponentially more difficult, potentially giving latecomers like China a chance to catch up.

“The catch-up is not possible unless the latecomer can pursue it at any cost and be persistent for decades, and the investment could carry on even without any profit, which is almost impractical,” Wu said.

“There is no better way for the Chinese side to get out of this predicament or to accelerate development than to subsidise, and subsidies plus time is the only way out, but this is a very inefficient approach.”