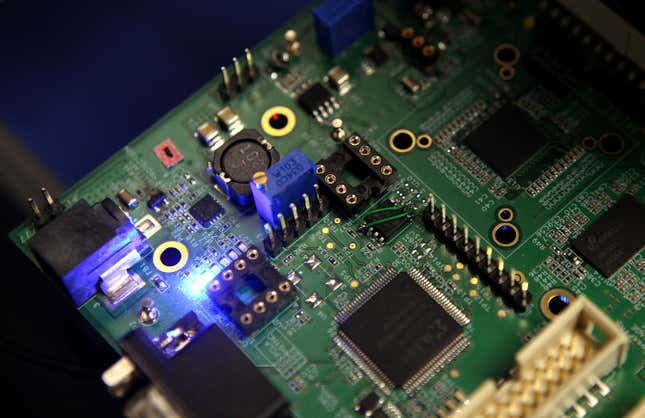

From R&D to manufacturing, the US semiconductor industry is one of the most advanced in the world. The American semiconductor ecosystem consists of developing materials and equipment for semiconductor production and research with universities across the country. Data on where all these operations take place are collected by the Semiconductor Industry Association. Mapping these locations reveals that research and manufacturing of semiconductors happens in almost every US state.

The US semiconductor industry globally

With about 12% of the global production, the US is the fifth largest manufacturer of semiconductors, behind Taiwan, South Korea, Japan, and China though its share of the global production has been declining steadily since the 1990s. Imports have been surpassing exports since 2009, and have risen even more sharply since the pandemic. The US government has made it a priority to promote the semiconductor industry, with a goal of beating China in the race for global microchip domination.

In 2022, American businesses operating in semiconductor production invested $50 billion to increase production, as part of a government program. And expanding US output could prove essential for more than just a competitive advantage.

Drought in Taiwan

Taiwan, the world’s largest producer of semiconductors, is likely to face yet another drought in 2023. Making chips is an extremely water-intensive process, and Taiwanese semiconductor makers may have to reduce their output to conserve water. The worst drought in a century brought the country to a halt in 2021, worsening the global semiconductor crisis that began during the pandemic.

Taiwan’s water shortages are likely to become more frequent, as they are exacerbated by climate change and fewer typhoons passing the island. This poses severe challenges to its microchip industry, which alone supplies a majority of the world’s demand. For Taiwan, losing share in the field will mean losing geopolitical relevance , and with it some support from the US and Europe, which is key to the country’s resistance to China’s expansionist threats.

For the rest of the world, any shrinkage of chip output results in supply delays and loss of productivity, particularly among high-tech industries. This represents an opportunity—as well as a necessity—for the US to expand its production.